Let’s talk about ways to simplify your finances. Managing money can be extremely rewarding, but it can also be stressful and overwhelming at times (especially when there’s not enough of it).

If you’re reading this blog, you likely share some of my same hopes and dreams for a simpler life. That’s why I want to share some practical tips for getting out of debt, increasing savings, and achieving financial freedom.

Getting a handle on money will give you more time and energy for the things that really matter in life. So let’s dive in and simplify our finances together!

1. Don’t spend money you don’t have.

Ignore all the offers for free 12-month financing and buy now, pay later deals. If you really, really want something that you can’t afford now, simply save to buy it.

While you’re saving and waiting, you can research all of your buying options and find the very best price and terms. (Or you might even be able to find your item for free instead of shopping.)

Often when I take my time on a purchase, I discover a better alternative or realize that I don’t even really want or need the item after all.

2. Stop using credit cards.

I finally started getting credit card debt under control when I took the cards out of my wallet and locked them in a drawer. Now I pay cash, write a check or use my debit card.

Could you do the same? If a friend asks you to dinner and you don’t have enough in your checking account to cover it, invite your friend over for dinner instead.

Try not to use your credit cards for incidentals like groceries or gas. If you can avoid debt and stop charging little expenses on your credit card, after a while your balance will start to go down instead of gradually rising each month.

3. Get out of debt.

If you’ve ever been horribly in debt, as I have, you’ll relate to the Bible’s description of debt as being like a heavy old millstone around the neck – constantly weighing one down.

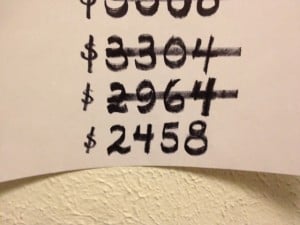

How would it feel to really own what you own, free and clear? If you have to make sacrifices to get out of debt, keep your eye on the prize – the freedom that will come from getting rid of that millstone. I made a wall sign with our total amount owed and keep it in front of me in my office so I can stay focused on the goal.

4. Pay down your mortgage.

When I was 21, I worked with a woman just a few years older than me who told me she was going to pay off her mortgage in five years. I’ll never forget what an impression it made on me, that she could dream such a big goal at a young age.

She not only paid off that mortgage, she was able to buy and rent out the three other units in her building before she turned 30. Every dollar extra that you pay with your mortgage payment can reduce your principal, which can save you thousands and thousands of dollars in interest and significantly shorten your loan term.

Just double-check your payment and make sure the extra amount you pay is clearly designated to apply to the principal. Begin to imagine how it would feel to own your home free and clear. People do it every day, and so can you!

5. Automate saving and investing.

One of the easiest ways to simplify your finances is to take advantage of automation. If your employer has an automatic savings plan, take advantage of it. Even if you can only afford to skim off $20 a month right now, do it.

Increase your savings as often and as much as you can. Soon those small amounts will add up to hundreds and thousands of dollars. Increase your savings every year. Set a goal to be your company’s biggest saver.

If you’re interested in working with a professional money manager, the National Association of Personal Financial Advisors can match you with a fee-only financial advisor. (See “Should Financial Advisors Get Paid to Sell Products?“)

6. Set up a Freedom Account.

The Freedom Account is a savings account for large annual expenses like HOA fees, taxes, your car’s annual registration fee and insurance payments. Simply figure out the total of those big annual payments, divide by 12, and put that amount aside each month. The fewer wild fluctuations you have in your monthly expenses each month, the easier it will be to manage your finances.

7. Set up and fund a Small Unplanned Expense Account.

This account should have one or two thousand dollars in it, for smaller emergencies like unexpected car repairs or a broken appliance. No more stress over small setbacks!

8. Set up and fund a Large Unplanned Expense Account.

To prepare for the unexpected, your goal should be to fund this account with about six months of living expenses, just like Suze Orman recommends.

Check your health insurance policy and figure out what the maximum annual out-of-pocket expense would be if you or a family member had a major health emergency. Make sure your Large Emergency Savings Account is funded with at least this amount.

9. Forget about impressing others.

Living with financial peace is much sweeter than carrying a designer purse or driving a high-status automobile. Whenever I find myself musing about what others will think of this or that, I try to consciously stop what I’m doing, let go of comparing myself to others, and reframe my thoughts.

The truth is that my friends don’t care at all what I drive or wear, and yours probably don’t, either.

10. Put some money in guaranteed savings.

Ignore the low interest rates and keep some of your money in a safe, FDIC-insured account, and the fluctuations in the stock market won’t keep you awake at night.

11. Watch spending on home improvements.

It’s easy to justify spending a lot of cash to make design improvements on a house. Tread carefully in this department. Reuse, recycle, make do, and get creative.

12. Make a budget.

You know the most surprising thing most people realize when they make a budget? They see how much money they actually have!

Just make a simple spreadsheet and start plotting your income and the amounts you need to pay expenses and reach your savings goals. Control your money, instead of letting your money control you. The best way I know to accomplish financial goals is to make (and stick to) a budget.

13. Reduce expenses.

When my daughter was just a baby, I had to return to work and put her in daycare when she was just six weeks old because we had such large monthly expenses including two car payments and a house payment – and zero money saved.

How I wish we would’ve made different decisions. Whittle your monthly expenses down as much as possible. Having low overhead is one of the best ways I know to enjoy financial peace.

14. Earn more.

When I was a magazine publisher, each year I had to make an annual budget and increase the profits from the previous year. I quickly learned that it was much easier to increase revenues than to cut expenses.

The same is true in real life. It’s always great to trim expenses as much as possible, but I’ve found that earning more income is a faster way to reach significant financial goals.

(Need help saving for the holidays? Here are 12 ways to earn extra money for Christmas.)

15. Save, save, save.

The stock market goes up and down, emergencies happen, life happens, and much of the financial world can seem beyond our control at times.

What we can control, however, is how much of our money we set aside and don’t fritter away. Saving money is one of those great habits like wearing sunscreen that you will never regret. Need help jump-starting your savings? Try a short money diet.

16. Keep some cash around.

Lock it in a safe place. You never know when you might need some cash for an emergency, or when your neighbor’s tree service might be willing to trim your tree for a great price if you can offer cash. This just happened at our house last month, and our old locust tree looks so much better after its $75 trim.

Need help accumulating cash? Check out the $5 Bill Savings Plan.

17. Give it away.

One of the best and most deeply satisfying aspects of financial control is the ability to give more. When our finances seemed especially tight a few years ago, I realized that I had become stingy about giving because I was trying to hold onto the little that we had.

When I started giving again, abundance returned. The financial concept of sowing and reaping is a wonderful paradox, and a lesson I am still learning.

18. Seek to be content.

I am still susceptible to the “Gimmes.” I daydream about big home improvements like solar roof panels, which leads me to think I’d like to get a new electric car, and while we’re at it I’d like new living room furniture, and vacations, and cute new boots, and on and on and on.

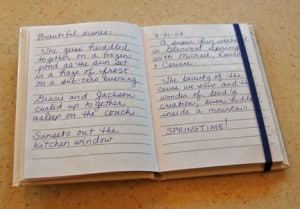

Learning to be content is an ongoing journey for me, and it helps me to consciously focus on thankfulness – sometimes through the practice of writing in a gratitude journal.

How do you simplify your finances? I’d love to hear your thoughts, experiences and additional ideas about this most important topic, so drop a comment below.

Meanwhile, my wish for each of you is overwhelming success in managing your money.

Save for Later

If you use Pinterest to save ideas, here’s a handy pin:

Eliza Cross is the creator of Happy Simple Living, where she shares ideas to help busy people simplify cooking, gardening, holidays, home, and money. She is also the award-winning author of 17 cookbooks, including Small Bites and 101 Things To Do With Bacon.

This is a great list… thanks for sharing. 🙂

Thanks, Tereza – glad you enjoyed it!

xo

Such a great list…..an area I really struggle with. Making a budget and sticking to it!!!! Just have not figured out a way to do it. It doesn’t help that I really do need my husband to be the “NO” man and he is the “IT’LL BE OK” man. It’s so very overwhelming for me. I’ll try and put some of these things to task and see if they can help me. Thanks for the post!!

Kimberly, I hear you! Some months I do better than other months. I’ve started jotting a monthly list of the exact amounts and dates I want to pay off bills and debts each month on my “To Do” list. It’s very satisfying to pay them off, and for some reason having it right there in front of me keeps me focused on the goals. I don’t know if this would help you or not, but thought I’d share it. Good luck! I’m pulling for you!! xo

Hi Eliza,

I simplify my finances using free online software like Personal Capital or Mint to keep track and not have to worry about logging into so many accounts.

Thanks for your nice thorough post. One recommendation I have for you is to add some social sharing plugins like Shareholic, or ShareThis so people can retweet and like your stuff!

Sam

Thanks for the great advice to use Mint (my personal fave) or Personal Capital to manage finances, Sam. I am going to check out those social sharing plugins right away, too! 🙂

I’d love to hear more about giving generously. I’m feeling the financial pinch and have noticed that I’ve started to get more greedy about sharing my money. I don’t want to spend as much on presents, I don’t tip as much and I’ve stopped giving to charity. I’m ready to start giving generously to charity again (if I can get my husband on board); but I’m hesitant about gift giving to family and friends, especially when they already have so much stuff, I’m afraid my gift will be wasted money. What are your thoughts?

Great list of ways to simplify your finances. I am inspired by your last year post regarding $5 savings plan. Thanks for sharing.

I am from Vietnam. I get here by Google. Thanks for your helpful advices. I am interested in basic living skill of human. I suppose it would be nice to be free from relying on others for our living.

great article,thanks! Setting up a freedom account is a must. If possible, once all the bills are paid I try to set aside 15% of my monthy salary

Impressive! Thanks for sharing 🙂