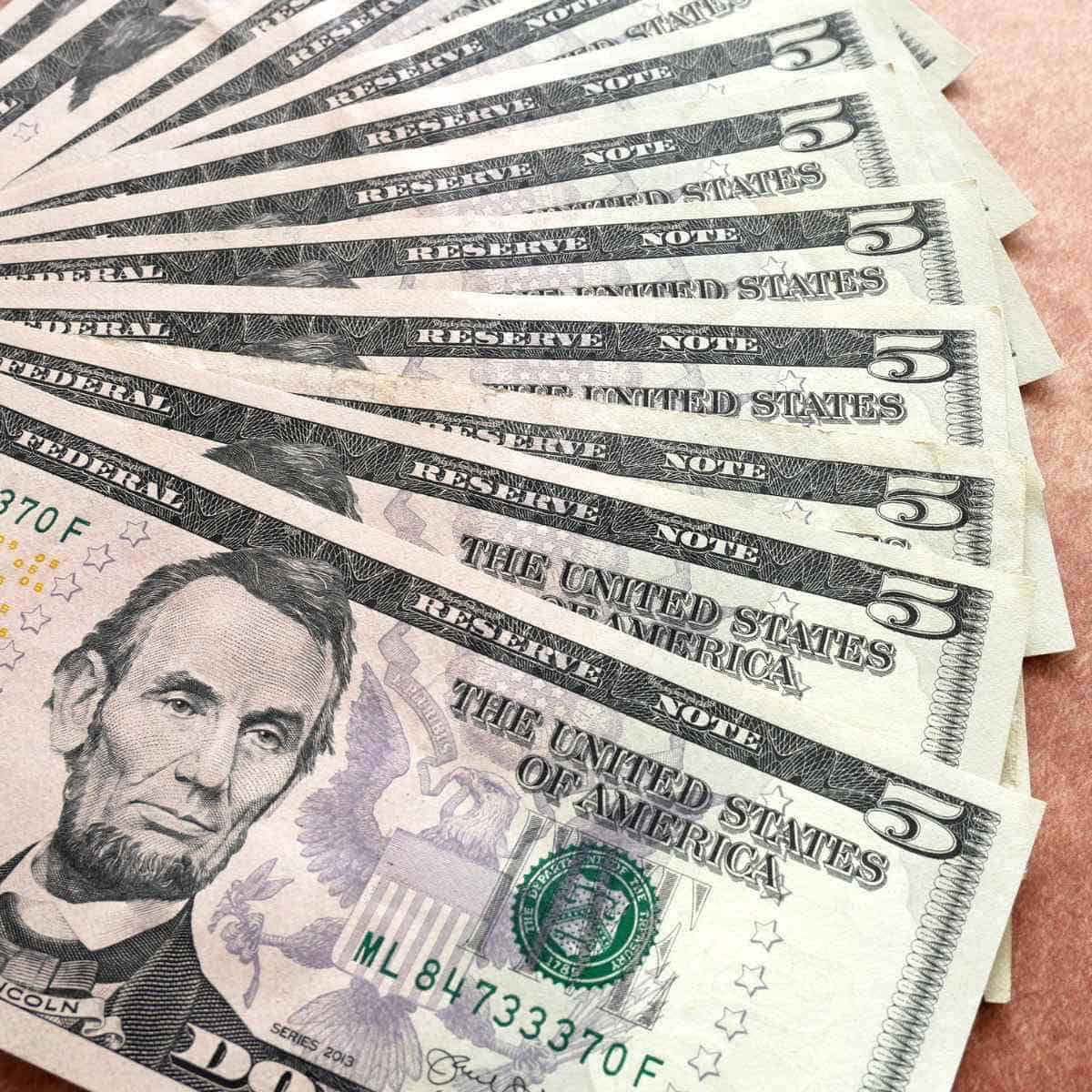

Have you tried the $5 bill savings plan? It’s a simple concept, and a fun way to save a little extra money.

The tip works best when paying cash for everyday expenses instead of pulling out a card. (A side benefit is that we’ll generally spend less when we pay cash instead of charging things on a credit card.)

The five dollar bill savings plan is simply the act of removing and saving $5 bills whenever one lands in your wallet. What I’ve discovered is that this practice is a simple and painless way to save.

I try to pay cash for as many expenses as possible. After I’ve accumulated six or seven five dollar bills, I deposit the cash in my credit union’s high-yield money market account. If I average about $35 a month, in a year I’ll have accumulated $420 plus interest.

It’s not a huge amount, but we all know that little savings can grow into significant amounts with persistence and consistency.

Spare Coins and $5 Bill Savings Can Add Up

As I wrote previously in “7 Free Things You Can Do This Week to Simplify,” another painless way to save money is by emptying the coins from my wallet into a container periodically. We always keep our eyes open and scan the ground for loose change, too.

When the coin jar is full, we deposit the contents in my son’s savings account. This year — after about five years of collecting coins — he was able to buy his first $500 certificate of deposit (CD).

We did the same thing with our daughter, and purchased her college computer with the savings we accumulated from loose change.

You might also enjoy going on a money diet for a couple of weeks or a month to make quick progress on your financial goals.

Do you have any simple ways to save money? Drop a comment below with your strategies!

Happy saving, and let me know if you try the $5 Bill Savings Plan!

Eliza Cross is the creator of Happy Simple Living, where she shares ideas to help busy people simplify cooking, gardening, holidays, home, and money. She is also the award-winning author of 17 cookbooks, including Small Bites and 101 Things To Do With Bacon.

I have been saving $5 bills for the last six or so months. I have accumulated quite a bit which I in turn deposit into a savings account.

I think thats a great idea. My husband and I do office cleaning for work and save all the cans and bottles from our accounts, then cash them in 2x a week, we get on average $80.00 a month, I was using it for coffee and such but now I think it would be better to put it in our savings account.

This works for me and I can save 2-3 paychecks per year. I call it: delayed gratification. If you get paid every 7-14 or 30 days….delay your pay (pretend you don’t have it) for just 1 day per week. Example–you get paid on Friday. Pretend you don’t get paid till Saturday. You have saved a day’s pay. The next week, pretend you get paid on Sunday. The next week, Monday, etc. At 1-3 points during the year, you will have your hands on 2 paychecks, and will only need one to pay bills. I pay for Christmas and vacation like this. Sounds odd, but it will work!

Seven years ago I became a widow. While my husband lived, he would come home from work and place all change but $2 in quarters (for vending machine drinks the next day) in an old 5 gallon water jug. Each year we would go on vacation on this savings. Since his passing it’s been difficult to put money away. I have used the $5 method for a little over a year. The savings amount to about $100 a month for me. Although, I do mostly deal in cash, my income is about $1,300-1,500 a month now. So it’s doable even for those without a lot of money. Every time I get a $5 back, I share the ‘value of $5’ with the cashier and anyone nearby. Several people at stores I frequent have tried it and told me thank you. Last year I paid for a crown on a tooth with the savings…something I may not have been able to afford otherwise. Whatever method works for you whether it be in cash or having your credit card charges round up the change amount to the next dollar and put that in savings, go for it, most will not miss the difference. Although, sometimes when down to my last $10 or 20, I’m just hoping they don’t give me a $5, lol.

I am late to the $5 savings plan, but not late to saving. I have been doing this with $1 bills. And in the past six months, I have managed to save $823 dollars…all in $1 dollar bills. My three year old daughter thanks I’m rich…lol…I on the other hand am showing her that saving can be fun. I also do this with my spare change, so whatever is returned to me after a purchase and it falls in the $1 dollar and spare change category, it’s saved. But I like this $5 dollar savings plan. I think that I will start this on the first of next month. Wish me luck.

Actually I do 1 week $1, 2 week $2 and so on and that leads to a saving of $1,378… What I did was I got a calender and and label each week $1, $2, and so on… Then I take what the total amount of saving that would have been for that whole month. Then I would take that amount and divide it by 2 because I get paid bi-weekly and see how much I need to put away per paycheck. Then someone suggested me to use cash when I buy my lunch stuff and put the dollar bills in an envelope and the lose change in the jar. The person explained to me that the loose change is the “interest” and the dollar bills will help build up the savings. So far it is doable for me and if I get any extra cash this year I will put it toward that savings plan…. plus holiday pay because of the holidays throughout the year is an extra boost in this savings plan. Plus my tax refund check will also add on to that savings plan as well….

Plus when I go shopping, I’ll use coupons and buy stuff on clearance when I see what I have saved during that trip I’ll put that money away like I have “spent” it. For example, today I bought clearance stuff and my savings was a total of $8.00 plus I found $0.11 in the parking lot. So when I got home I put $8.00 in the envelope and the $0.11 in the jar EASY!!!!

Plus doing a list of needs vs wants and also because of the internet to see what I can do for free on the internet. Also I make my own homemade bread and since I can make 4 loaves of bread in just 1 lb of flour. So everytime I make bread I’ll put $2.00 aside because I would have used that $2.00 on store bought bread anyways. Now I’m making my homemade pasta when I want spaghetti and that is an extra $1 or $2 saved. That goes in the envelope…. Plus I stop buying pop and stop drinking pop so an extra $3 is saved that goes in the envelope and WHOA it all adds up to alot of money saved :)…..

Just saying… It is doable, it takes time, patience, and creativity….

I have started this plan with an additional slight twist to it. Every time I go to the grocery store I ask always pay with my debit card, so i ask for $5 in cash back to add to this savings plan. So far I’ve accumulated an additional $100!

I saw this plan on a tv show a few days ago. I have been looking into starting it. Thanks for letting me know how it works. I started it today.

I changed the $1 savings to $5 savings. My husband and I enjoy checking off the weeks on the calendar. So far we have each saved on $450.00. I started the 52 week with a dollar for myself and remarked to him how easy it was to save. I then suggested to save five dollars and it has begun a challenge for us as a couple. At the end of the year we will have close to $7000. A nice little nest egg.

I started doing this saving plan four weeks ago. Every Monday when I get paid. I automatically transfer $5.00 to an online savings account that offers 1% interest. I’m saving my loose change and $1.00 in a jar. I also have a Acorns Account that round ups my spare change on every purchase I make from my checking account. I also just started a 26 week plan by adding money into it weekly until I reach $1,000. I might do the one for $5,000 instead. Every little bit counts.

I’ve always saved change but, after seeing the $5.00 plan on a daily talk show, I decided to give it a try. This was about 2 months ago. My eyes sparkle every time I get a 5 dollar bill in my hands. If I find a 20.00 or a 10 in my purse that I didn’t know was there, I throw that in too. Ones always go in as well.

They say you should have, at least, 2 months wages put away for a rainy day fund so, that’s the first thing I’m saving for.

I occasionally buy scratch off lottery tickets and, if I win, I put the original investment back in my purse and the remained goes in my jar. To date, I’ve saved over $200.00. We don’t make a lot of money but, this is so doable!

I started this several years ago [ I never could save any money ] well the first time I did this I saved 5,600 dollars in five dollar bills and purchased a 1931 ford that I always wanted but couldn’t afford, I’ve still got the car and now have another 3,500 dollars for something not sure what but when I see it I’ll be ready with cash in hand This works real easy for me and it doesn’t hurt P.S. When I purchased the Ford my wife said we can’t afford that so I showed her my five dollar collection [and she said go for it ] wife approved now we cruise around in style

I’ve been saving my $5 bills for about 10 years. I took my family on a Disney cruise in 2020 and we’re leaving for Hawaii at the end of march with our $5 trip. 10/10 recommend!

I love your story! Thank you so much for sharing your experience, and how saving consistently over time can lead to great results. Have a fantastic time in Hawaii! ~Eliza