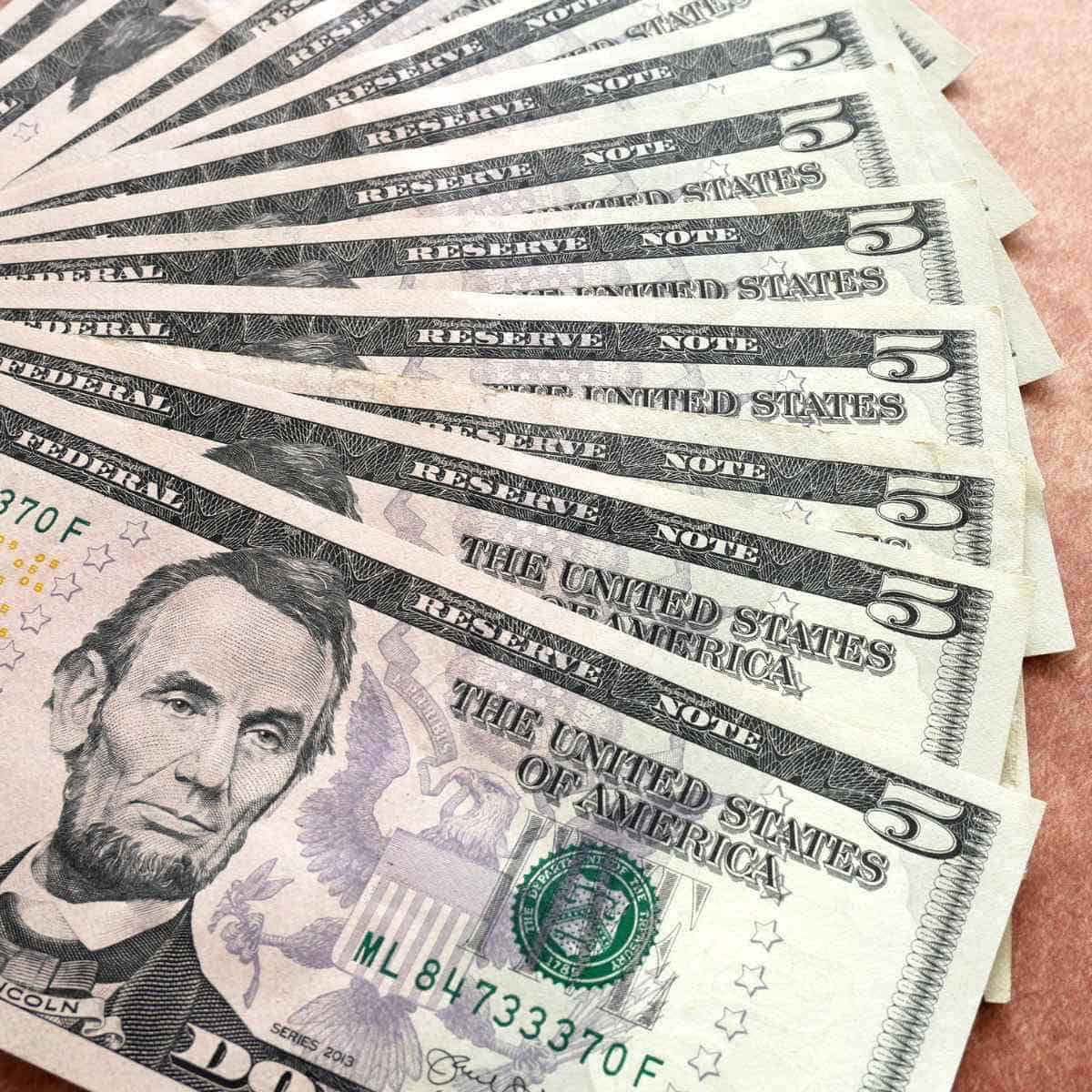

Have you tried the $5 bill savings plan? It’s a simple concept, and a fun way to save a little extra money.

The tip works best when paying cash for everyday expenses instead of pulling out a card. (A side benefit is that we’ll generally spend less when we pay cash instead of charging things on a credit card.)

The five dollar bill savings plan is simply the act of removing and saving $5 bills whenever one lands in your wallet. What I’ve discovered is that this practice is a simple and painless way to save.

I try to pay cash for as many expenses as possible. After I’ve accumulated six or seven five dollar bills, I deposit the cash in my credit union’s high-yield money market account. If I average about $35 a month, in a year I’ll have accumulated $420 plus interest.

It’s not a huge amount, but we all know that little savings can grow into significant amounts with persistence and consistency.

Spare Coins and $5 Bill Savings Can Add Up

As I wrote previously in “7 Free Things You Can Do This Week to Simplify,” another painless way to save money is by emptying the coins from my wallet into a container periodically. We always keep our eyes open and scan the ground for loose change, too.

When the coin jar is full, we deposit the contents in my son’s savings account. This year — after about five years of collecting coins — he was able to buy his first $500 certificate of deposit (CD).

We did the same thing with our daughter, and purchased her college computer with the savings we accumulated from loose change.

You might also enjoy going on a money diet for a couple of weeks or a month to make quick progress on your financial goals.

Do you have any simple ways to save money? Drop a comment below with your strategies!

Happy saving, and let me know if you try the $5 Bill Savings Plan!

Eliza Cross is the creator of Happy Simple Living, where she shares ideas to help busy people simplify cooking, gardening, holidays, home, and money. She is also the award-winning author of 17 cookbooks, including Small Bites and 101 Things To Do With Bacon.

My husband and I do the same thing with coins. We always use the money we cash in to go on nice dates. I’m liking the $5 plan though, and may have to give it a try. Thanks for sharing!

I love that idea! I rarely have cash on hand, but this is a great way to save a little more than just the spare change. I’ll have to try this tip. Thanks!

That is a great idea – unfortunately i’d end up saving nothing through that because I never carry cash. My best savings strategy is the automatic transfer – I do 3 auto transfers to some accounts a few times a month, and they are just built into my budget. Every time I want to increase one, I lower another one.

We use a large juice jar to save up coins – I hadn’t heard about the $5 bills though – that’s a great idea. We may have to give that a go.

Yes! It’s work… I have been saving my $5 over a year now. God gave me this idea about two years ago, but I wasn’t seriou at first. Then God challenge me to collect 100 $5 bills that will equal to 500.00. I have over 100 $5 bills I am excited! Also I save coins as well, but it’s works.

We were saving coins for a while but then it never really added up. I want to start using cash and doing it again to see if we can save more. I like the $5 plan though that will get us going faster. My easy way is to cut back on monthly bills and then put that savings into savings. Like we cancelled cable so I put that $80 a month in savings like I am still paying the bill. I am looking into doing that with our phones now too, cutting the land line and just using cell phone and even finding a cheaper cell phone plan (looking at straight talk from walmart which is only $30 a month) so then I would put that $30 for land line plus $30 for cell savings into savings account every month. Do the same with coupons or whatever you “saved” at the bottom of your receipt at the grocery store and it really adds up quickly.

I am the original author of a column on my habit of saving five dollar bills. The story first ran in the Boston Globe in 2008. I’ve been saving each and every $5 that passes through my hands now for 7 years and I’ve put away $20,000 using this method.

I love it. I just started saving and already have over $40.00. I save every $5 I get. I’m saving for a vacation, or an unexpected emergency.

My husband and I just began about 8 weeks ago saving $5 bills and we have over $300 already. I never thought I would be so excited to receive a $5 bill in change from anywhere. It immediately goes into a special spot in my wallet, then when I get home, into a zip bag. At first people laughed at us when we told them about it, but look who’s laughing now!

Hello I see ur post on here how did u save up to $300 for only 8 weeks did u save every $5 bill time u get one or how didu do it let me know you did it

My husband and I also save our change, we collected different size wine glass jugs for each of the silver coins. Then at the end of the year we roll them, and trade them into the bank (pays for christmas 🙂 I deffinatelty am going to do the five dollar plan. It seems like a great way to save up, but won’t hurt your pocket if you do not have it.

we do the same, put all coins from the day into a pot and empty them once for summer holiday and once for christmas shopping. my mom did this as well. now $1 and $2 also come in coins so the savings come much faster. we also do a $5 savings, but it is $5 a day. finally each month we put the child allowance into the children’s savings account for when they are 18. however even with this saving we still don’t own a yacht ;o)

Awesome idea! I’ll definitely be trying this!

I never spend my change or my $1 bills, unless it’s for a tip or at yard sales. Also, when I am balancing my checkbook I round up to the next dollar amount, so if I wrote the check for $4.23 I would deduct $5. This works for debit card transactions also. When I deposit a check I don’t add in the change. It is amazing how fast this all adds up without any effort. It’s also nice to have a little cushion for those times that there is an error in balancing.

This is awesome! I first saw this on Pinterest and decided I had to do it! I’m going to go collect all my 5$ bills now! Yay!!

I’ve also been saving my coins for a few months and have about 20$. So exciting!

Thank you for posting this idea!!! 😀

The $5 saving plan is a blessed awesome savings plan. This is my 3rd year saving $5 bills. Today I deposited over $1700 (from one year $5 bill savings) into my CD account which I opened in 2010 when my first $5 bill savings were deposited. As of today, I have saved and deposited over $5000 in $5 bills into my Smart 30 CD account. Enjoy the journey!

The first time I did the $5 bill savings, I saved $1,500 which I used towards a brick patio. I recently started in mid July and already have $715.oo. This time, whatever I save in change a month, I match it in cash. So if I have $20 in change, I add a $20 bill to my $5 bills each month. It adds up!

I love this idea! Will start implementing today!

I have done the $5 Savings plan off and on for years however I have done it a little differently. My plan is with 5’s AND 10’s, I make a consious effort to always carry cash with me and make my purchases with cash instead of a debit or credit card therefore I most certainly will get change. Also, if I am making a purchase less than $5 for instance, I NEVER use that $5 or $10 I may have in my wallet, I will use a $20 then I receive a 10 and a 5 for change. I keep an envelope in my console in my car to put the bills in so I am not tempted and then I also have a place at home to hold the stash as well. Truly we never will miss that $5 or $10 and saving both adds up so fast you won’t beleive it especially if you are paying cash for everything. Try it, your trip to Maui will come even quicker 🙂

I AM DOING THE FIVE DOLLAR PLAN AND IT WORKS! I ALSO KEEP A 50.00 BILL IN MY WALLET. I AM REACHING MY GOAL. IT’S GREAT.